Hedge funds bet on a weaker pound as the Starmer crisis intensifies

With the future of British Prime Minister Keir Starmer uncertain, hedge funds are betting on further weakness in the pound.

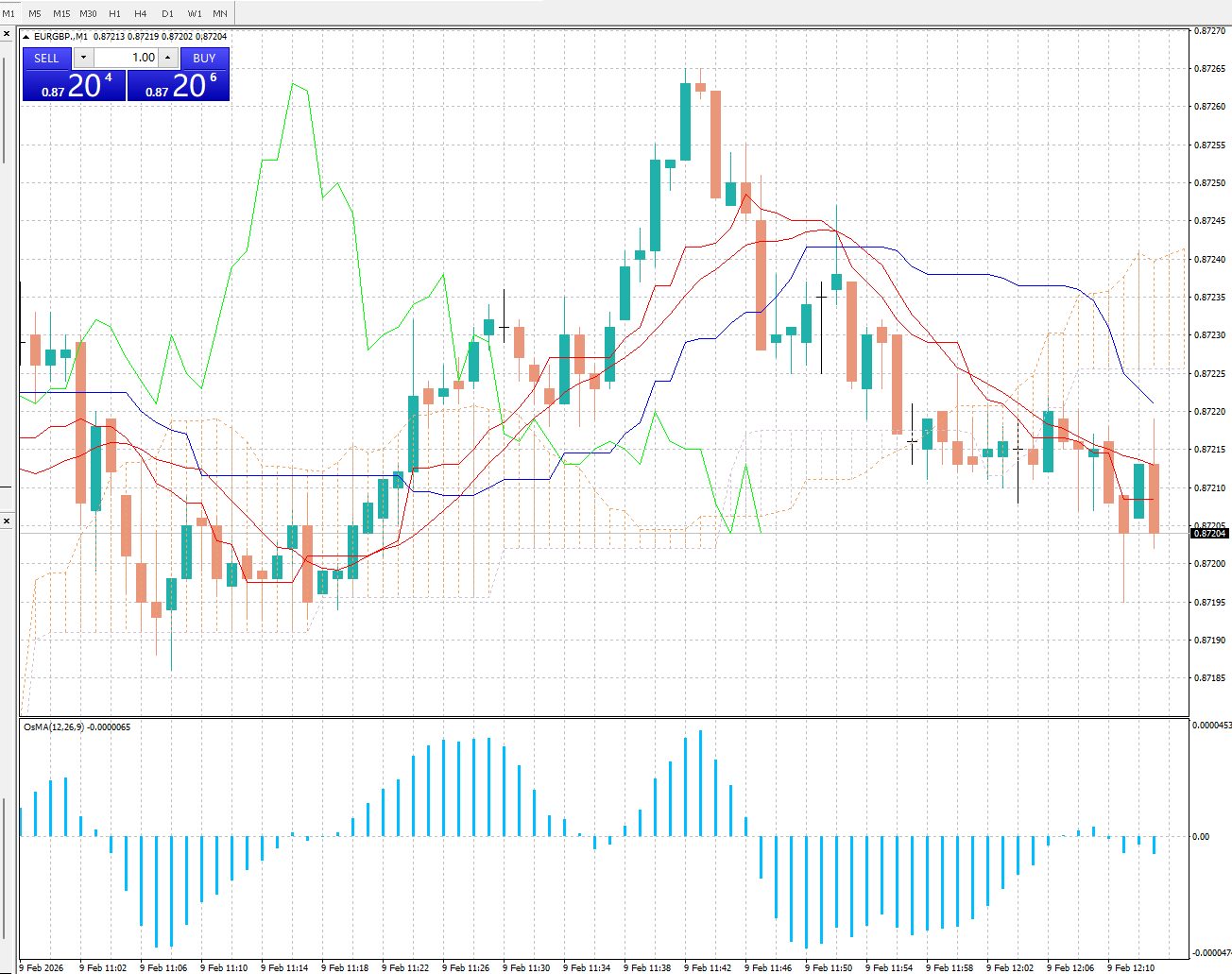

On Monday, the pound fell 0.5% against the euro to 0.8725, a new low since January 22. This followed the resignation of Starmer’s chief of staff on Sunday, who was unhappy with Peter Mandelson’s appointment as ambassador to the United States, further escalating the political crisis in the UK. Last week, the pound was already under pressure due to market concerns about the prime minister’s ability to maintain power and the Bank of England’s near-passing decision to cut interest rates.

The renewed political uncertainty dragged down UK government bonds at the open. The yield on 10-year UK government bonds rose 3 basis points to 4.55%, near its highest level since November last year.

Similar to the price action during the November budget announcement, options traders are increasingly viewing the euro as the best tool to hedge against UK-specific risks. Options premiums for a decline in the pound against the euro surged last week to their highest level since late November, and the largest increase since July, compared to expectations of a decline in the pound against the euro over the next month.

According to data from The Depository Trust and Clearing Corp., trading volume in euro/pound options reached its highest level since 2019 on February 5. If the pound weakens against the euro, trading volume in call options will increase; conversely, if the pound strengthens against the euro, trading volume in put options will increase by 50%.

Thomas Biro, global head of FX options trading at Societe Generale, said that hedge fund inflows into euro/pound are “still a one-way flow, with strong buying,” referring to demand for call options following the market volatility on February 5. “The pound’s trading volatility is similar to that of emerging markets, influenced by a stronger global dollar and high sensitivity to geopolitical news.”

This latest development is undoubtedly adding insult to injury for the pound, which had already depreciated by more than 5% against the euro last year. Goldman Sachs strategists predict the pound will depreciate 6% against the euro over the next 12 months, while Nomura Holdings forecasts a 3% decline by the end of April.

According to RBC Capital Markets, the pound was already under pressure ahead of the Bank of England’s decision, given Starmer’s increasingly precarious position as UK leader.

“Notably, we’re seeing market demand for EUR/GBP appreciation,” said Jamie Saunders, head of foreign exchange options trading at RBC in London. He added that this demand has led to a significant increase in the implied volatility of the currency pair—a measure of expected price movement.

Volatility is expected to reach its highest level since December last year over the next month. In a low-probability scenario, DTCC data shows a clear market preference for buying EUR/GBP upside exposure, suggesting that the market perceives tail risk skewed towards further pound weakness.

Despite high market focus on the UK local elections on May 7, April contract trading was more active. This is likely due to pre-election hedging or early positioning. Demand for options with strike prices above 0.90 (a level last seen in 2022) accounted for approximately 15% of call option trading volume last month, and about 50% of total option trading volume expiring after June.

Rabobank FX strategist Jan Foley believes that assuming the dollar avoids another major sell-off, the euro may rise slightly against the pound by mid-year, while the pound may fall against the dollar. She added that while Starmer was previously expected to face a leadership challenge after the May local elections, this could now happen sooner.

“If the next prime minister is likely to come from the Labour left, then the market will be highly vigilant about political instability in the UK,” Foley said.

before: Oil Prices Fall as Middle East Tensions Ease, Supply Risks Reduced

next: Tech stocks drove a Wall Street rally ahead of data releases