FXCG Market Summary: US Stock Index Futures Fall, Tech Sell-off Likely to Continue

Global stock market sell-off is expected to intensify further on Friday, after sharp declines in US tech stocks and cryptocurrencies dampened risk appetite, prompting investors to turn to US Treasuries.

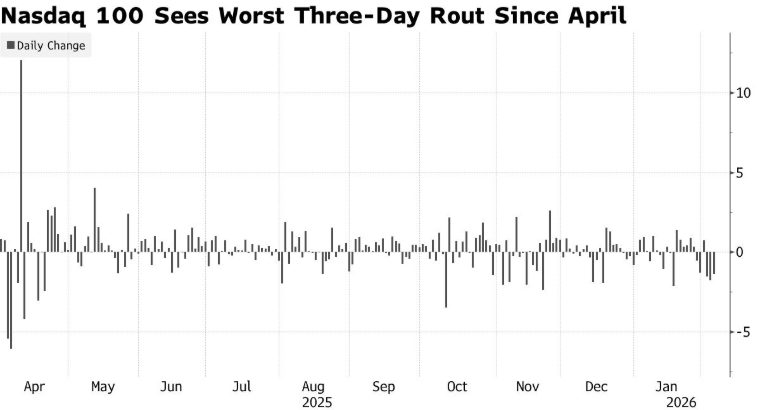

US stock index futures opened more than 0.6% lower on Friday, following a broad decline in Wall Street indices, with the Nasdaq 100 suffering its worst three-day drop since the April crash. The benchmark index has lost more than $1 trillion in market capitalization since Federal Reserve policymakers hinted last week that they were reluctant to cut interest rates again in the near future. Asian stocks are also expected to open lower.

Amazon shares plunged as much as 11% in after-hours trading, highlighting the plight of tech stocks. The company said it plans to spend $200 billion this year on data centers, ships, and other equipment, raising concerns among investors about the scale of its artificial intelligence investments.

Weak market sentiment battered Bitcoin, which plummeted to around $63,000, losing nearly half its value since October of last year. U.S. Treasury prices rose, with the two-year Treasury yield falling to its lowest point in nearly a month. Silver prices plunged 20% on Thursday, and gold prices fell 3.7%. Precious metal prices stabilized in early Asian trading on Friday.

Unlike the panic selling triggered by President Trump’s trade war last April, this market turmoil was not caused by a single factor. Instead, a series of news events has continuously fueled concerns about overvaluation, leading many to suspect that valuations are already too high, ultimately resulting in a mass exodus of funds.

This was further evidenced by the S&P 500 falling 1.2% on Thursday, marking its third consecutive day of decline, and the Nasdaq 100 posting its biggest drop since April. Software stocks fell sharply after artificial intelligence company Anthropic launched a new model designed for financial research, highlighting the competitive threat posed by this new technology.

Pessimism was further amplified by rising unemployment claims, coupled with the lowest number of job openings in the U.S. in January since 2020, and the highest number of layoffs announced by companies in January since 2009.

The yield on the 10-year U.S. Treasury note fell 9 basis points to 4.18%, and the yield on the 10-year Australian government bond opened lower on Friday. The dollar rose 0.3% on Thursday, while the yen fell for the fifth consecutive trading day, trading at around 157 against the dollar.

The pound fell as expectations for a rate cut next month rose due to the Bank of England’s unexpectedly close interest rate decision. Meanwhile, oil prices fell as Iran confirmed it would hold talks with the United States on Friday.

before: Federal Reserve Chair Lisa Cook Says Central Bank Must Maintain Inflation Credibility