FXCG – Asian Stocks Fall as Tech Sell-Off Intensifies

Asian stocks fell for the second straight day, with selling pressure intensifying on tech stocks, further fueled by investor concerns about overvaluation and massive spending in the artificial intelligence sector.

The MSCI Asia Pacific Index fell 0.7%, with stocks such as Samsung Electronics and SoftBank Group leading the decline. The Korea Composite Stock Price Index (KOSPI) – a benchmark for AI investment – led the losses, falling 2%.

This followed the Nasdaq 100’s worst two-day plunge since October, breaking below its 100-day moving average, which some analysts see as a harbinger of further declines. Shares of Alphabet Inc., Qualcomm Inc., and Arm Holdings Plc fell in after-hours trading following weak earnings reports, further dampening market sentiment. However, U.S. stock index futures contracts rose 0.3%, suggesting that selling pressure may be easing.

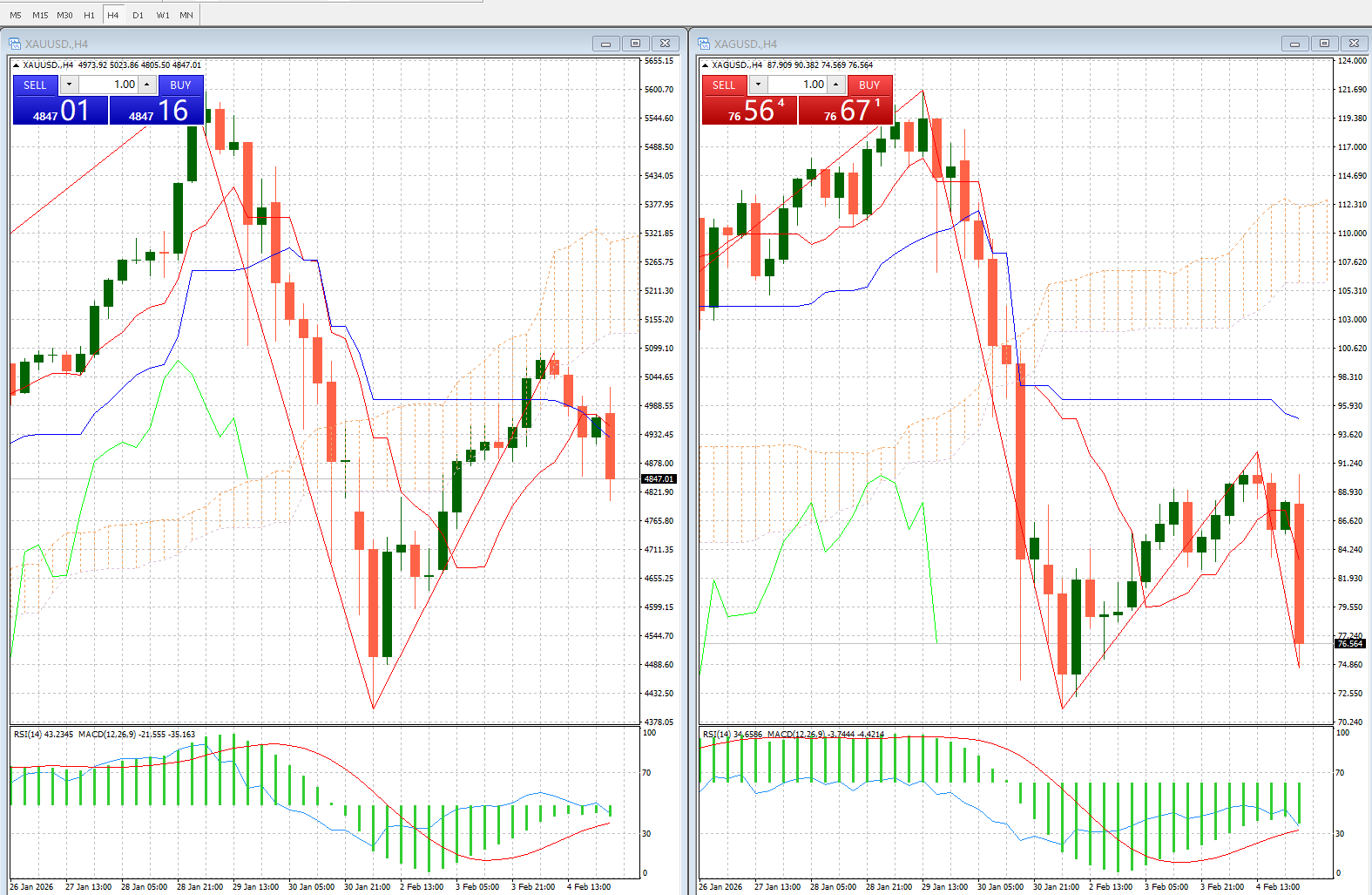

In other markets, gold and silver prices fluctuated wildly, showing mixed results; Bitcoin prices fell below $73,000. The yen weakened slightly against the dollar, trading at 156.91, extending its losses ahead of the Japanese general election this weekend. The Bloomberg Dollar Spot Index maintained its gains from the previous session.

While sell-offs triggered by artificial intelligence have occurred before, the scale of this week’s plunge sweeping through stock and credit markets is unprecedented. Investors are turning to other sectors as the US economy shows resilience, amid concerns about overvalued tech stocks, soaring capital spending, and the risk that AI could erode existing software business models.

During US trading hours, tech stock rotation was the dominant trend, with software companies experiencing another round of selling, but chipmakers suffered even greater declines.

In just two days, the market capitalization of stocks, bonds, and loans of major Silicon Valley companies evaporated by hundreds of billions of dollars. Software stocks were hit hardest, with the plunge so significant that the market capitalization of software stocks tracked by the iShares ETF shrank by nearly $1 trillion in the past seven days.

Traders are also closely watching the movements of precious metals. Gold and silver prices fluctuated, retreating after hitting record highs on Friday, essentially maintaining gains from the previous two days. Last month, precious metal prices surged, driven by speculation, geopolitical turmoil, and concerns about the Federal Reserve’s independence. However, this rally came to an abrupt halt at the end of last week, with silver experiencing its biggest one-day drop ever on Friday, and gold suffering its biggest decline since 2013.

In other market sectors, the pound and euro remained stable, awaiting interest rate decisions later on Thursday. The market widely expects the European Central Bank and the Bank of England to keep interest rates unchanged.

In other news, US President Donald Trump and Chinese President Xi Jinping discussed trade and geopolitical hotspots, including the Taiwan issue, in a phone call on Wednesday. The two sides plan to hold a face-to-face meeting later this year.

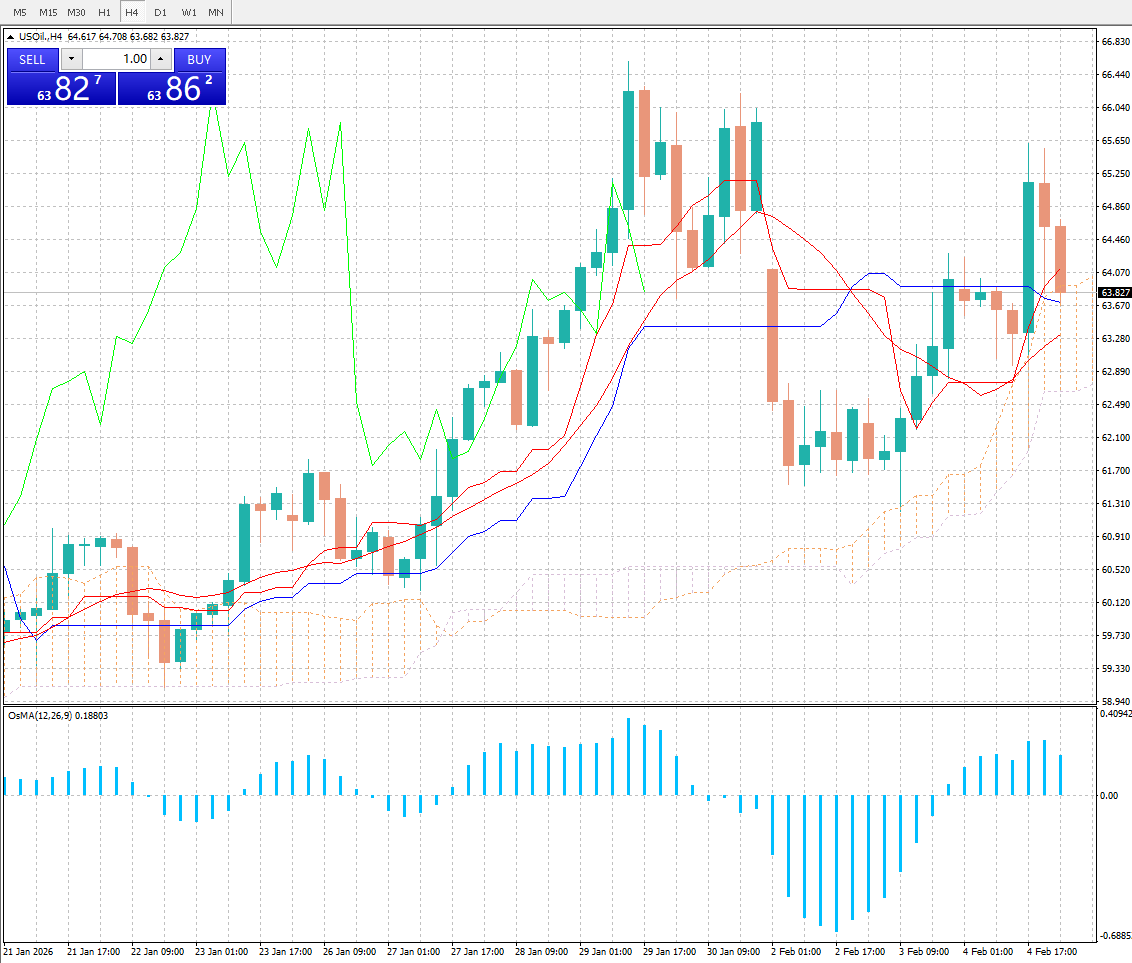

In commodities, oil prices fell for the first time in three days after Iran confirmed it would hold talks with the US, easing the immediate risk of a military strike against the OPEC oil-producing nation.

before: FXCG – AI Fears Trigger Stock Market Turmoil, Gold Price Breaches $5,000 Mark

next: Federal Reserve Chair Lisa Cook Says Central Bank Must Maintain Inflation Credibility