FXCG – AI Fears Trigger Stock Market Turmoil, Gold Price Breaches $5,000 Mark

Software stocks have been hit by sell-offs, leaving the stock market with an uncertain outlook, while the price of gold has climbed back above the key threshold of $5,000 per ounce.

On Wednesday, stocks sensitive to economic conditions led the gains, with the Russell 2000 Small Cap Index futures rising 0.4%. S&P 500 Index futures edged up 0.1% ahead of Alphabet’s earnings release, while Nasdaq 100 Index futures dipped 0.3%. Advanced Micro Devices (AMD) shares fell 9% in early trading due to disappointing sales expectations. In Europe, chemical and automotive stocks turned in a strong performance.

Concerns over the disruptive impact driven by artificial intelligence have reignited, sustaining the trend of capital rotation into cyclical stocks and weighing on the market. Tuesday’s sell-off was triggered by the launch of a new automation tool by Anthropic PBC, and the downward momentum spilled over into the financial services and asset management sectors. On Wednesday, cautious sentiment remained rife, with a basket of European stocks perceived to be vulnerable to AI disruption dropping 1.2%.

“I don’t think the market has fully determined whether this sell-off is driven by fear or fundamentals. But what is certain is that we are indeed experiencing a confidence crisis at the sector level,” said Stephanie Niven, portfolio manager at Ninety One. “Instead of rebuilding confidence at the level of truly important companies, we are seeing this indiscriminate sell-off.”

Despite U.S. businesses adding fewer jobs than expected in December, U.S. Treasury bond prices saw little movement. The U.S. dollar rose 0.1%. Bitcoin hovered around the $76,000 mark. The Japanese yen extended its losses as traders bet that the Liberal Democratic Party led by Prime Minister Sanae Takaichi would win the election this weekend.

Worries about disruptive innovation have complicated the distinction between winners and losers in the AI space. Against a backdrop of stretched valuations and the ongoing earnings season, investors have begun punishing companies that fail to meet lofty expectations.

Alphabet is set to face another test when it reports earnings after the market close. Since the start of 2025, the parent company of Google has been the best performer among the “Magnificent Seven” tech giants. Last week, the market reacted sharply differently to the earnings releases of Microsoft and Meta Platforms, reflecting divided opinions on whether the massive investments in AI are paying off.

“The biggest risk in tonight’s earnings release is that while Google has solidified its leading position in AI in the long run through its vertically integrated approach, there is a disconnect between this and the short-term trends in search and profitability, which could be more volatile,” said Jacques-Aurélien Marcireau, co-head of equities at Edmond de Rothschild Asset Management.

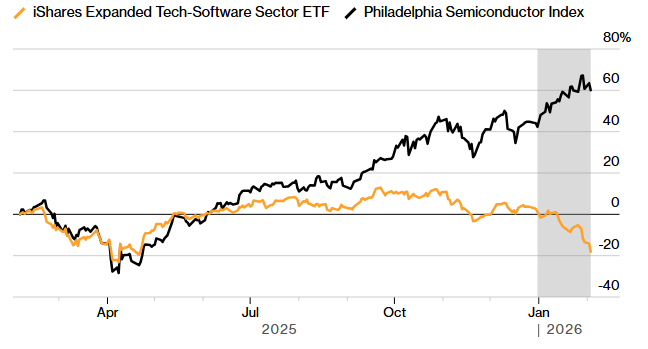

Toby Ogilvie, analyst at JPMorgan Chase, noted that investor sentiment toward software stocks and other industries seen as affected by AI development is deeply pessimistic.

Having met with more than 50 investors across Europe and the United States over two weeks, Ogilvie said they have significantly reduced their holdings in software stocks over the past 12 to 18 months. He pointed out in a client note that even after the recent pullback, “investors’ overall willingness to step in and buy remains generally low.”

“There is clearly an indiscriminate sell-off across the entire software sector,” said Karen Kharmandarian, senior equity investment manager at Mirova in Paris. “The market has no bottom in sight, and the downward momentum is too strong. It looks a bit like a capitulation sell-off, and once the market stabilizes, there could be some selective buying opportunities.”