Market Overview: Asian Stocks Poised for Decline Amid AI-Driven Market Turmoil

Asian stocks fell on Friday, impacted by renewed pessimism surrounding artificial intelligence (AI) on Wall Street. US tech stocks and Bitcoin prices weakened as investors flocked to the safe-haven US Treasury market.

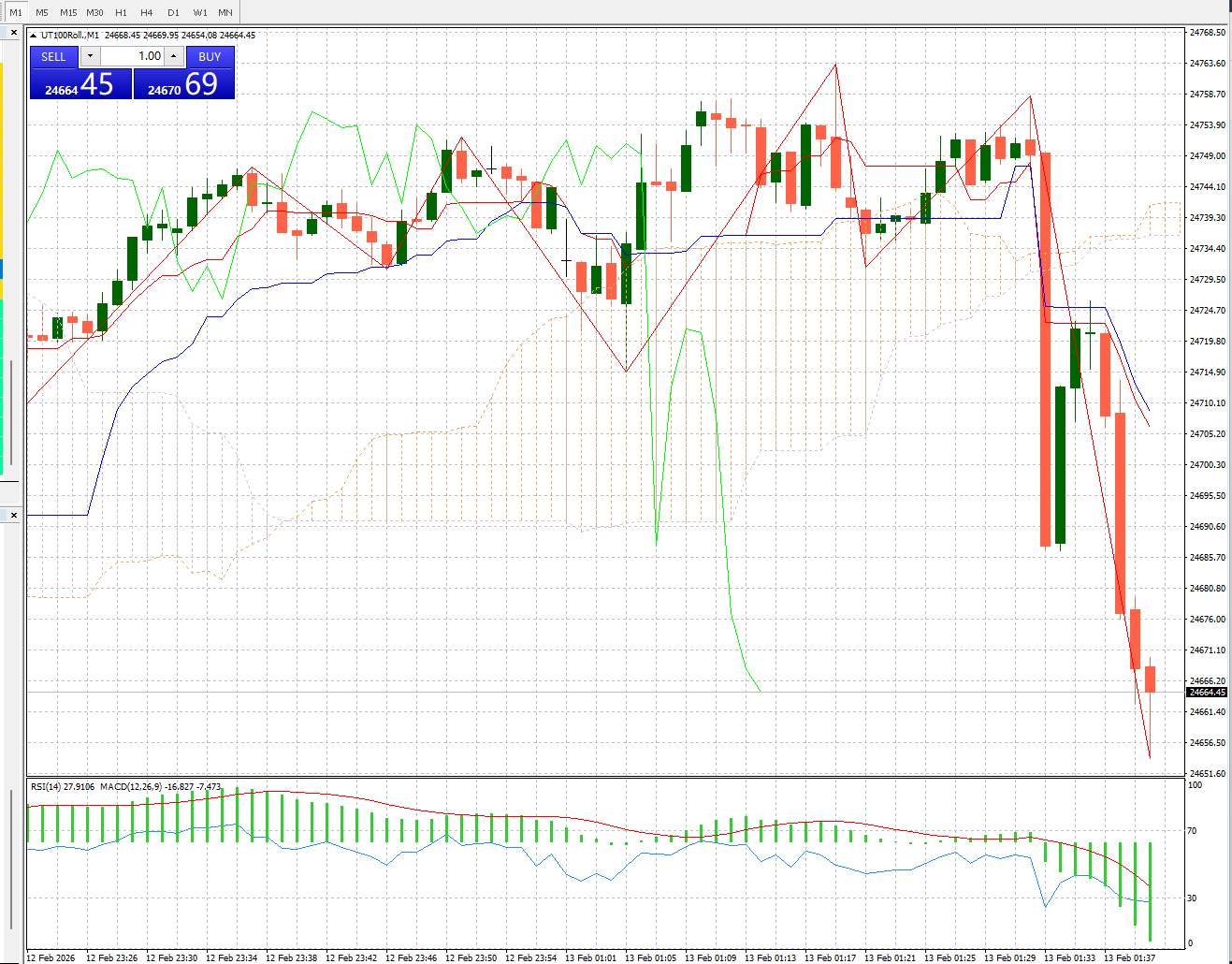

On Thursday, the S&P 500 fell 1.6%, and the Nasdaq 100 dropped 2%, with large-cap stocks generally declining. This wave of decline spread to sectors such as logistics and commercial real estate, indicating investor concerns about the impact of AI. Cisco Systems shares plunged 12% as weak profit margin expectations suggested that rising memory chip prices were impacting the company.

Fears weighed on Japanese and Hong Kong stock index futures, and Australian stocks opened lower. US stock index futures rose slightly in early Asian trading, suggesting the market may have found support after recent volatility.

The US Treasury yield curve rose across the board, pushing the two-year Treasury yield down 5 basis points and the ten-year Treasury yield down 7 basis points to 4.1%. Gold prices stabilized on Friday after falling 3% in the previous session, with algorithmic traders appearing to amplify the precious metal’s sudden drop. Silver and copper prices also declined. Bitcoin rose slightly in early trading on Friday after four consecutive days of losses.

The sharp fluctuations in U.S. stocks reflect the growing risks associated with the artificial intelligence (AI) boom and its unpredictable ripple effects across industries, regions, and asset classes. These fluctuations highlight how a shift in sentiment surrounding AI can quickly spread beyond the tech sector to broader areas.

Later on Friday, the U.S. will release its January inflation data, with the median market forecast showing a 2.5% year-over-year increase in the core consumer price index, excluding food and energy prices.

Traders continue to view a low probability of a rate cut by Federal Reserve officials at their next meeting in March, with the market having fully priced in a July rate cut.

Benjamin Wiltshire of Citigroup said the market is overly optimistic about the U.S. inflation outlook, making trades that could profit from rising price pressures look attractive. He noted that investors may be underestimating the resilience of U.S. consumers, and market expectations for inflation may be slightly revised upward. “The market seems to generally believe that inflation will fall. But we are still in a structurally high inflation environment,” Wiltshire said in an interview.

In commodities, oil prices fell as risk aversion permeated global markets and investors digested the latest developments in US-Iran tensions, which continued to cloud the supply outlook.

Despite the overall market pessimism, there were some positive developments in the US stock market. Shares of Applied Materials Inc. surged 10% in late trading after the company released unexpectedly optimistic sales guidance, indicating that demand for artificial intelligence and memory semiconductors is driving equipment purchases.

Meanwhile, Anthropic completed a financing deal, raising $30 billion from investors at a valuation of $380 billion (including funds already raised). A memo reviewed by Bloomberg News also revealed that OpenAI warned US lawmakers that its Chinese competitor, DeepSeek, is using unfair and increasingly sophisticated methods to steal results from leading US AI models.

In terms of trade development, the United States and Taiwan finally reached an agreement to reduce tariffs, improve market access for U.S. products in Asia, and invest billions of dollars in U.S. energy and technology projects.

before: European stocks rose on earnings reports; U.S. Treasury prices were flat