Alphabet Plans to Issue First 100-Year Bond in the Tech Sector Since the Dot-com Bubble

Alphabet plans to issue a rare 100-year bond as part of a massive debt issuance. This marks the first time a tech company has issued such long-term debt since the late 1990s.

According to a source familiar with the matter, the 100-year bond will be denominated in pounds sterling, along with four other pound sterling bonds. The source, who requested anonymity, added that this is Alphabet’s first issuance of pound sterling bonds and pricing could occur as early as tomorrow.

Data shows that this is the first time a tech company has issued such an ultra-long-term bond since Motorola issued one in 1997. The 100-year bond market is primarily dominated by institutions such as governments and universities. For businesses, potential acquisitions, outdated business models, and technological obsolescence make such deals extremely rare.

However, given the massive debt that tech companies need to raise to stay ahead in the race to build artificial intelligence capabilities, even extremely rare deals are making a comeback.

“They want to attract all types of investors, from structured finance investors to ultra-long-term investors,” said Gordon Kerr, European macro strategist at KBRA. He also noted that the main buyers of 100-year bonds will be insurance companies and pension funds, “and the underwriters are unlikely to be the beneficiaries at maturity.”

However, according to data, besides government issuers, only EDF, Oxford University, and the Wellcome Trust have previously issued 100-year bonds denominated in this currency.

These bonds were all issued in 2021, a year when, according to Bloomberg indices, yields on high-grade sterling bonds fell to historic lows. Due to their very long duration (trader terminology referring to price sensitivity to interest rate changes), all these bonds were priced well below par.

According to data, the lowest coupon rate of the three bonds was issued by the Wellcome Trust, with a coupon rate of 44.6 pence per pound. Bond prices and yields have an inverse relationship.

Not all ultra-long-term bonds survive. JC Penney, a struggling retailer, filed for bankruptcy in 2020, just 23 years after issuing its 100-year bond.

Alphabet announced its 100-year bond issuance, along with multiple tranches of bonds in the US dollar market. The tech giant had previously launched a marketing campaign for a seven-tranche bond offering, expected to be priced later today. According to another source familiar with the matter, the company also plans to issue Swiss franc bonds.

Alphabet last entered the US bond market last November, when it raised $17.5 billion in a roughly $90 billion deal. As part of that deal, the company issued a 50-year bond—the longest-term tech company bond denominated in dollars last year, according to data compiled by Bloomberg—which has seen tight trading in the secondary market. The company also issued €6.5 billion (approximately $7.7 billion) in bonds in Europe at that time.

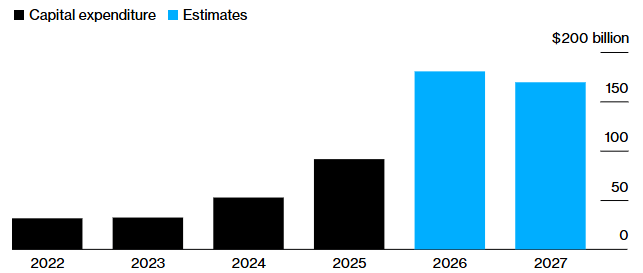

This massive debt deal was struck less than a week after Alphabet announced it would spend a staggering $185 billion in capital expenditures this year (double last year) to fund its ambitious plans in artificial intelligence.

Other tech companies, including Meta Platforms Inc. and Microsoft, have also announced massive spending plans for 2026, and Morgan Stanley predicts that mega-cloud computing companies, known as hyperscale data centers, will borrow $400 billion this year, up from $165 billion in 2025.

However, issuing 100-year bonds is likely to remain a rare occurrence.

“It’s hard to say whether this will become commonplace,” said Kerr of KBRA. “It’s not common even in the Treasury market.”

before: Tech stocks drove a Wall Street rally ahead of data releases