Oil Prices Fall as Middle East Tensions Ease, Supply Risks Reduced

Oil prices fell as tensions eased in the Middle East, reducing the likelihood of near-term supply disruptions.

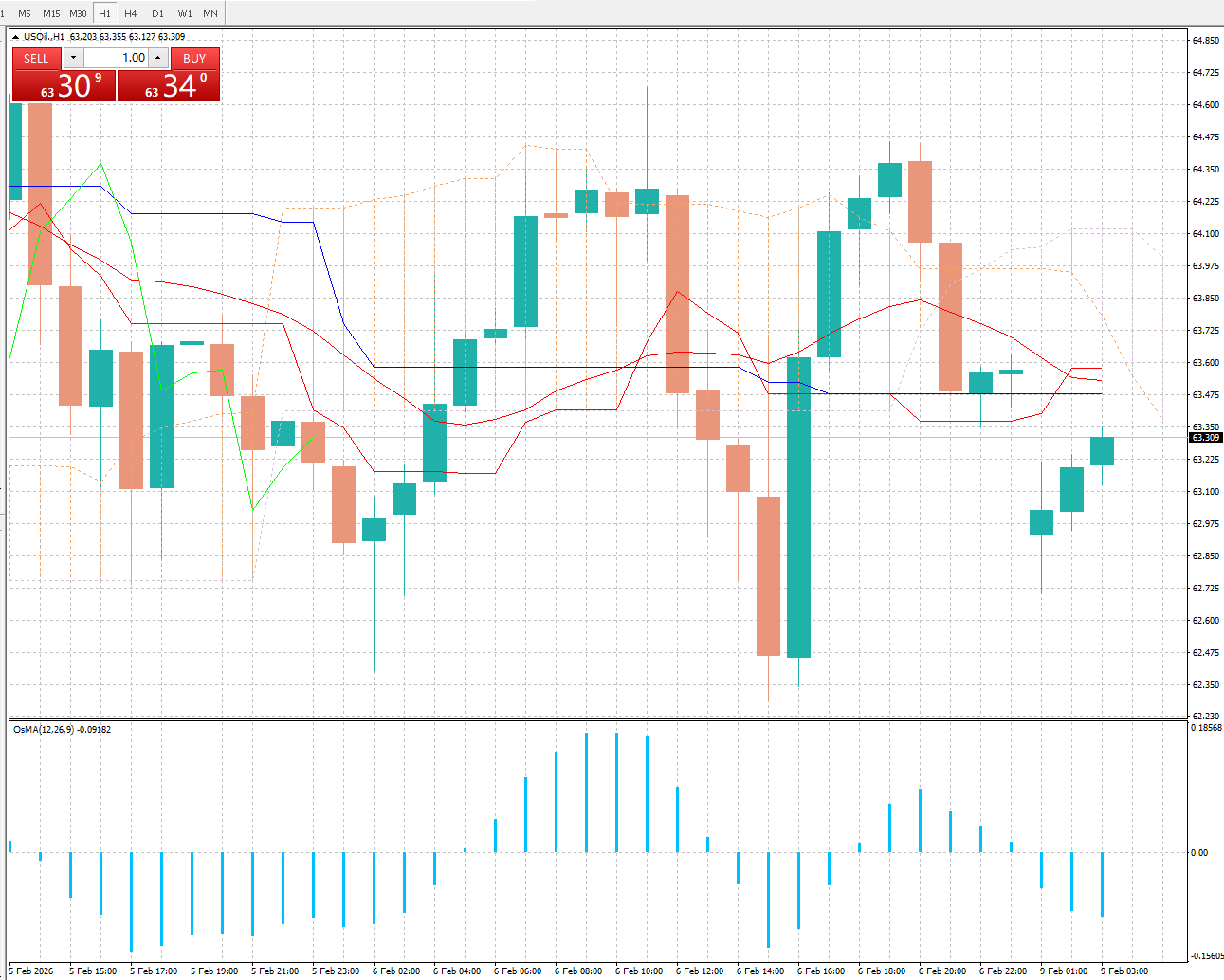

Brent crude fell below $68 a barrel, after falling nearly 4% the previous week, while West Texas Intermediate crude approached $63 a barrel. Iran and the United States held talks in Oman on Friday in an attempt to de-escalate tensions over Iran’s nuclear program, with Tehran calling the talks a “step forward.”

President Donald Trump indicated that another meeting would be held early this week as Washington has amassed military forces in the region. The US leader will also meet with Israeli Prime Minister Benjamin Netanyahu and prepare to impose a package of tariffs on countries trading with Tehran.

Despite widespread market concerns about a crude oil supply glut, oil prices have risen steadily since the beginning of 2026, supported by geopolitical tensions and some supply disruptions, including from Kazakhstan. However, oil prices retreated last week following signs of easing tensions between Iran and the United States. Traders believe these developments have reduced the likelihood of near-term military intervention.

Traders are also closely monitoring capital flows to India. Trump has stated that the South Asian nation has agreed to halt crude oil imports from Russia as part of a trade agreement. However, New Delhi has not directly confirmed this commitment, with the Indian government emphasizing that ensuring energy security remains its top priority.

This week will provide numerous clues about the global crude oil supply and demand balance, with the release of updated analysis reports from US official forecasting agencies, OPEC, and the International Energy Agency. Additionally, speakers such as Vitol CEO Russell Hadi will address the International Energy Week in London.

Ahead of the US-Iran talks, traders have increased their bets on rising crude oil prices. According to ICE Futures Europe’s positioning data, as of the week ending February 3, hedge fund bullish sentiment towards Brent crude reached its highest level since April of last year.

before: ECB President Piero Cipollone said the ECB will assess the impact of the euro’s strength in March.